Mediacle Group AB: Profitable and Growing Business Trading Close to Net Cash

Mediacle Group AB is an affiliate marketing company with a market capitalization of 126 million SEK. For simplicity, all figures will be presented in SEK going forward. What stands out about Mediacle is its balance sheet, currently holding 102 million SEK in cash and short-term investments—meaning the company is effectively 80% net cash.

Operationally, Mediacle has been profitable every year since scaling up in 2019 and has not posted a single annual operating loss. Over the past six years, the company has averaged 19 million SEK in cash from operations annually. Revenue has grown from 31.1 million SEK to 69.3 million SEK during this period, representing a 17% CAGR. The price-to-cash flow from operations (P/CFO) multiple is below 7. While the EV/FCF multiple is just 1.3, I don’t consider this metric particularly meaningful in Mediacle’s case, as the company’s unusually large cash position makes the figure deceiving.

Additionally, the CEO, who is also the founder, owns 85% of the company, significant insider alignment, but the high ownership concentration could also raise concerns regarding voting power and decision-making. I will discuss the CEO’s capital allocation in more detail below. Below are the key financial figures that I gathered from their annual reports.

With these kinds of numbers and management incentives, there must be a reason why the stock trades at such a low valuation. I’ll address those factors later. But first, here’s an overview of what the company actually does.

Mediacle Group offers a wide range of digital services and IT solutions to a global client base, with a particular focus on the iGaming sector and lead generation, as well as through their own B2C portals within iGaming.

The company has six business areas:

Game Development

Software

Design & Development

Digital Marketing

Lead Generation

B2C Brands

Their strong team provides everything needed within the iGaming ecosystem in one place—from branding and design to development, lead generation, digital marketing, and CRM.

Now let’s turn to the red flags and uncertainties.

The description of the company above essentially covers all the information Mediacle provides about its business, and it was extremely difficult to find any additional details about the company or its customers. This lack of information creates significant uncertainty about whether the business model is truly sustainable.

While the company has posted solid EBIT margins of 10–20% over the past five years, the limited disclosure makes it difficult to assess the durability of these results—or to form any clear view on the company’s future growth prospects. Based on what little information is available in the annual report, it appears Mediacle has a fairly large and diversified customer base in terms of quantity. However, most of its clients operate in the iGaming and software development sectors, so the company’s revenue is not well diversified across different industries. Additionally, it is unclear whether advances in AI could potentially disrupt Mediacle’s business model.

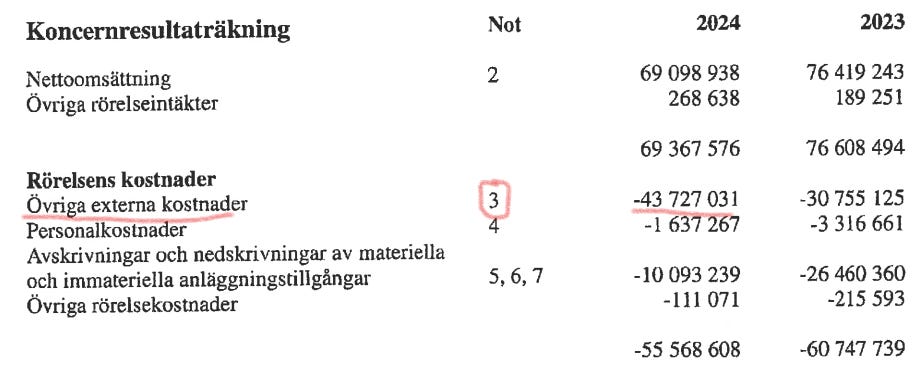

Another concern for me is the lack of transparency and the general confusion surrounding Mediacle’s accounting. For example, their “övriga externa kostnader” (other external expenses), shown in the image below.

These other external expenses account for around 80% of Mediacle’s total operating costs. However, I couldn’t find any explanation in their annual reports regarding what these costs actually consist of. My assumption is that they are related to commissions paid to affiliate partners for driving traffic, or possibly advertising expenditures—but ultimately, it’s unclear. The reports do reference footnote 3 for more information, which reads as follows:

Footnote 3 only refers to auditor fees, which have nothing to do with the company’s other external expenses as said—and the numbers don’t even add up. I also checked earlier annual reports and found the same issue: there is still no clear explanation for these substantial external expenditures.

Another thing I found odd in their accounting is the tax situation. I don’t understand how they’ve ended up paying tax rates ranging from 44% all the way up to 185%. According to their footnotes, their base tax rate is about 20%, but a lot of their expenses aren’t tax-deductible, and they also pay taxes in foreign countries—so that’s supposedly why the effective tax rate is so high. What I don’t get is why these non-deductible expenditures wouldn’t just show up under capex instead. Maybe someone reading this can explain it to me. For anyone interested, here’s the footnote:

My biggest concern, however, is capital allocation. Typically, when valuing a company with cash on its balance sheet, investors subtract this cash from the market cap to arrive at enterprise value—assuming the cash will eventually be put to productive use or returned to shareholders. In Mediacle’s case, the cash pile is almost as large as the entire market cap, which would ordinarily make the company appear extremely cheap. However, the CEO has given no indication—either in annual reports or elsewhere—of any plans to deploy this capital or return it to shareholders.

The only use of cash I found was a small investment in cryptocurrency, which I view as a red flag. First of all, crypto is an asset class I prefer to avoid. More importantly, if management couldn’t find a better use for their substantial cash reserves than investing in cryptocurrency, it doesn’t give me much confidence that they’ll make smart capital allocation decisions in the future.

All that said, it seems like the market has pretty much priced in that nothing is going to happen with the cash. Either the company just keeps hoarding it and the valuation doesn’t really move—or maybe goes up a bit as the cash pile gets bigger, with investors hanging on to the hope that the CEO will eventually do something. But the stock isn’t incredibly cheap on an earnings basis—around 10x earnings—so for me, that’s not enough to get excited about the potential returns from earnings.

The other scenario is that at some point, they actually decide to allocate the capital. Then, depending on what the CEO does, you could see a much quicker move in the share price. But with his track record—remember, the only notable investment so far has been into crypto—the range of possible outcomes is pretty wide, both positive and negative.

So even for me—someone who’s usually pretty comfortable with uncertainty—I honestly have no idea what could happen here. The company looks really cheap on an asset basis and isn’t losing money, but with this level of opacity and unpredictability, I have to pass. That said, I also wouldn’t be surprised if the share price does well at some point—the downside should be fairly well protected with such a large cash pile.