Growth company in deep-value territory

A company benefiting heavily from economics of scale in an industry that is expected to grow 22% CAGR until 2030 trading at 0.4x EV/S.

AudioBoom

Audioboom is a global leader in podcasting, achieving over 135 million downloads each month in 2023, attracting 38 million unique listeners. This reach positions Audioboom as the fourth-largest podcast publisher in the United States, according to Triton Digital. The platform offers value to its podcast partners through a range of services, including commercial monetization, distribution, and production. In essence, Audioboom connects podcasters with companies to facilitate advertising deals.

Operating on an international scale, Audioboom has global partnerships across North America, Europe, Asia, and Australia. The platform distributes content through popular channels such as Apple Podcasts, YouTube, Spotify, Pandora, Amazon Music, Google Podcasts, iHeartRadio, Facebook, and Twitter, as well as on partners’ websites and mobile apps.

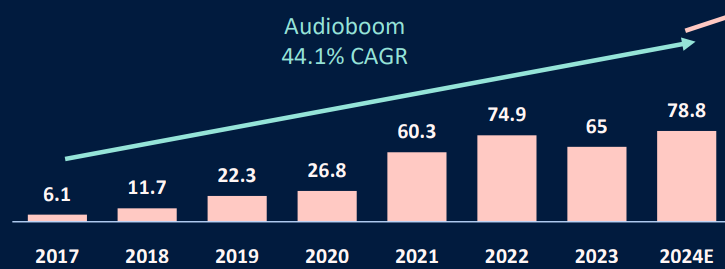

Though still in its early stages, Audioboom has increased its revenues from $1 million in 2016 to $65 million in 2023.

Elevator pitch :

Audioboom has a fixed-cost structure and is positioned to leverage this advantage to achieve profitability. While recent industry-specific setbacks have affected growth and pushed the stock down 90% since its 2022 peak, I believe these challenges to be one-time events and are not expected to hinder long-term growth. With the industry projected to grow at a 22% CAGR until 2030, the company’s current valuation of 0.4x EV/S presents an attractive opportunity. If one believes this company could reach a 10% profit margin with increased scale, this investment effectively offers a chance to buy into a high-growth industry at just 4x earnings.

Let’s dive in to latest issues:

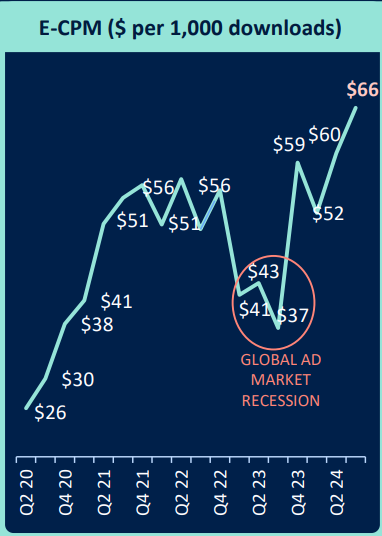

The global advertising market recession in late 2023 had a significant impact on this company’s performance, particularly in the digital audio ad space. As reflected in the graph, the downturn led to lower effective cost per mille (eCPM), reducing the rates advertisers were willing to pay for every 1,000 podcast downloads. This decline in ad pricing hurt the company’s revenue streams, contributing to a substantial pre-tax loss of $16 million in FY 2023. Compared to today's market cap of 34 million.

However, as the market recovered, so did eCPM rates, which positively influenced the company's Q3 2024 earnings. The company reported growth of 34%in top-line revenue, driven by both higher ad rates and possibly an increase in ad inventory or audience reach. Gross margins also improved significantly, rising from 3% to 20%, highlighting the operating leverage the company has. Additionally, the company achieved a 5% EBITDA margin, signaling a return to profitability with potential for further margin expansion as revenue continues to grow.

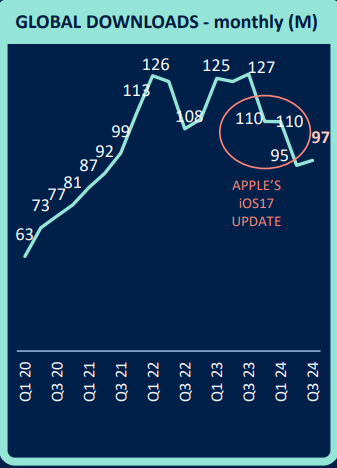

Another issue was Apple's iOS 17 update in September 2023. This update removed automatic downloads for back-catalogue content on the Apple Podcasts app, which historically represented a large share of podcast listening. This change resulted, according to the latest annual report, an estimated 32% reduction in downloads industry-wide. In simpler terms, this iOS update reduced the number of downloads counted, impacting the primary metric used by advertisers to pay for podcast ad placements, which in turn affected revenue growth. Management estimates that iOS17 change restricted their revenue in the first half of 2024 by an estimated US$9 million (26% of their revenue).

While this initially poses a challenge, the company believes it will actually offer long-term benefits. With more accurate data on actively engaged listeners (since auto-downloads inflate audience metrics without guaranteed engagement), advertisers will see a higher return on investment on their podcast ads. This increased ad efficiency could strengthen demand and pricing in the long run, benefiting the company's revenue and growth as brands invest more confidently in podcast advertising.

Given the recent news, one might expect the stock price to have rebounded after the company reported accelerating earnings growth and a return to profitability. However, that has not occurred, as illustrated below.

At its peak, the stock traded at 2,260 pence, whereas it currently stands at 210 pence. Fundamentally, not much has changed except for the setbacks mentioned earlier and some deterioration in the balance sheet, particularly following a significant loss in 2023. Nevertheless, the company still remains debt-free and holds 3 million in cash.

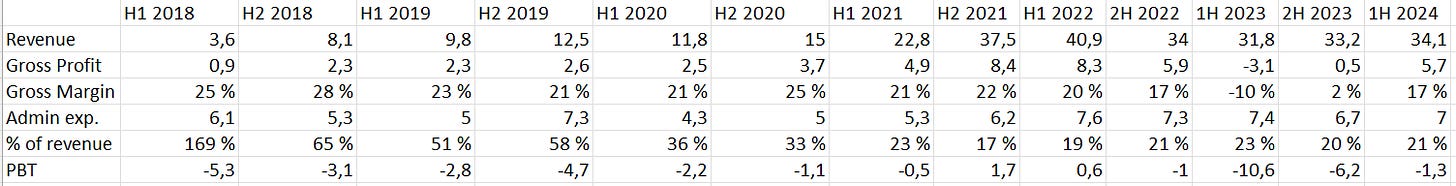

To demonstrate the company’s operating leverage, let’s examine its historical financial reports:

Notably, since the first half of 2018, the company has nearly tenfolded its revenue while only marginally increasing its administrative expenses. Additionally, it’s worth highlighting that the average headcount in 2023 was 39, a decrease from 51 in 2018, further proving the company’s scale advantage.

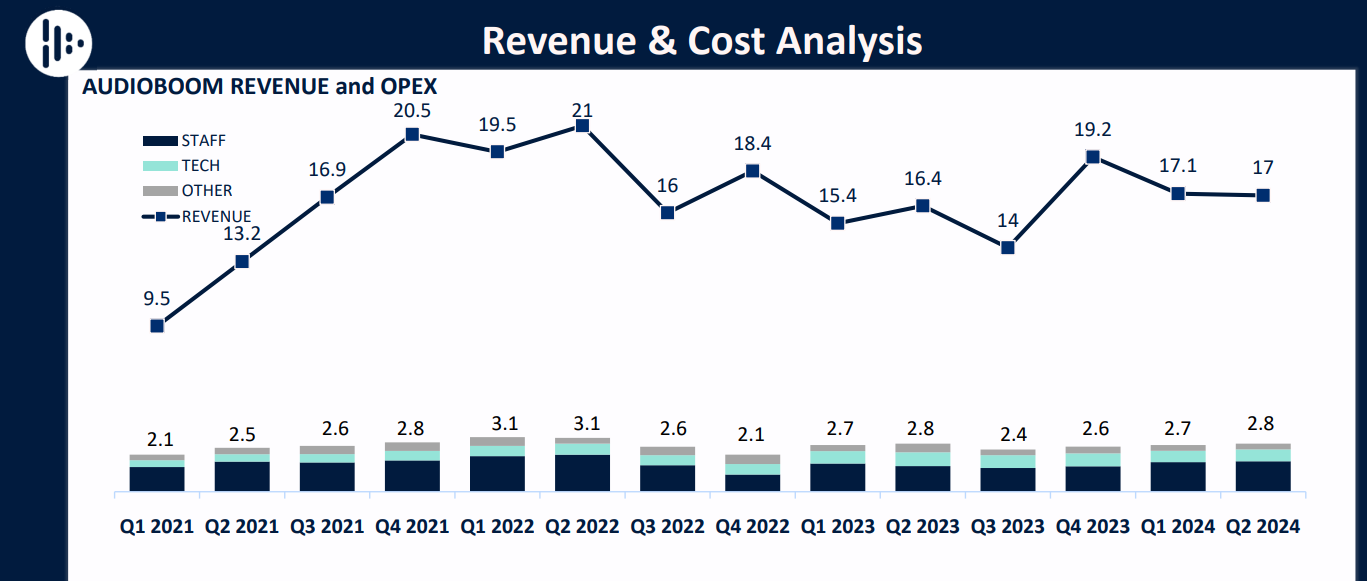

Here’s another chart taken from Audiobooms latest Q3 investor presentation. Note the marginal change in OPEX throughout the years.

Management team:

Michael Tobin, the Chairman of the Board and largest insider shareholder, owns approximately 5% of the company and has continued to increase his position as the share price has declined. A serial technology entrepreneur and philanthropist, Michael previously served as the ‘maverick’ CEO of Telecity Group PLC (now part of Equinix Inc.). During his time there, he successfully grew the company’s market capitalization from £6 million to £1.6 billion by the time he departed in 2014.

After stepping down from Telecity, Michael turned his focus toward supporting entrepreneurs, businesses, and leaders in the digital and technology sectors. In recognition of his contributions to the digital economy, he was awarded The Order of the British Empire by Her Majesty the Queen in 2014.

The CEO, Stuart Last, has not attained significant ownership in the company but has increased his position slightly during 2023. Before joining Audioboom, Stuart managed podcast operations at Voxnest in New York City. He also held executive roles at the BBC in London, where he oversaw digital strategy for BBC Radio 2, the UK’s largest radio station, and contributed to the development of key brands at BBC Radio 1, including the internationally renowned Live Lounge. Stuart joined Audioboom in 2014 as Chief Operating Officer, where he launched the business in the U.S. and led all strategy, business development, sales, and marketing operations.

Why do I believe the stock is trading for such low valuations?

Historically, the company has experienced rapid growth, attracting numerous growth-oriented investors. However, in 2023, as growth stagnated, and revenues even declined, this likely drove away the majority of growth investors. I believe this shift led to an overreaction by the market, resulting in an exaggerated drop in the stock price.

Additionally, the stock’s recovery has been hindered by limited market coverage. The company only publishes full earnings reports semi-annually—annual and half-year reports—while quarterly updates consist only of investor presentations and meetings, which are posted on YouTube. The recent Q3 investor meeting, where they discussed a return to 5% EBITDA margins and signaled renewed growth, got only around 150 views. Despite surpassing market expectations for Q3 and expressing optimism that Q4 will further outperform analyst expectations, the stock price remained unmoved, reflecting how the lack of visibility may be delaying a market response.

Catalysts:

With the upcoming release of their annual report, I anticipate that the company will once again be recognized as a profitable and growing entity. If they surpass analyst expectations, as indicated in their Q3 report, this should further impact the share price positively. While I view this company as a long-term hold, I see a short-term catalyst arising from the upcoming annual report set to be released in three months.

The company has also mentioned the possibility of listing in the U.S., which would enhance liquidity and reduce the risk of being overlooked by investors. The management team believes that pursuing a U.S. listing before achieving $100 million in revenue and $10 million in EBITDA may not attract the mature investor base that they need. However, they are confident that they will reach these milestones in the mid-term, providing another catalyst for the stock.

Interesting find. Agree that market reaction seems overdone. Will take a deep dive into this one.